Posts feature partner companies & may be sponsored. Post contains affiliate links & I will be compensated if you make a purchase after clicking on links. As an Amazon Associate I earn from qualifying purchases.

Last Updated on August 31, 2021 by Diane Hoffmaster

This post about your college student's first apartment was sponsored by Purchasing Power as part of an Influencer Activation for Influence Central. All opinions expressed in my post are my own.

This year, my two college students are living in an apartment for the first time. They are living TOGETHER, which makes my life a little easier, however, apartments are not cheap. Over the last few months, I have learned a LOT about college apartments. From finding safe locations to buying cheap furniture, where you choose to put your money really matters.

Of course, there are some things you just have to pay for in your kid's new apartment. And if you don't have the money RIGHT NOW, finding a reputable and financially sound way to pay for needed expenses is incredibly important.

So, I want to share a few ways to save money on the apartment process and let you know how federal employees can shop using interest-free payroll deductions with Purchasing Power.

Table of Contents

Purchasing Power Makes Financial Sense

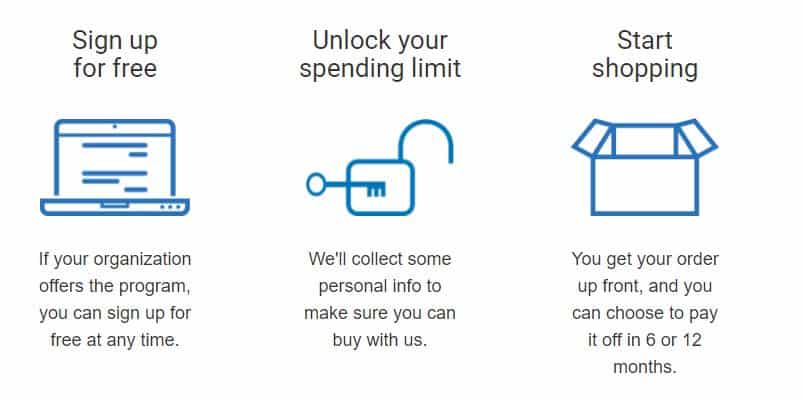

What is Purchasing Power? Basically, it is a program offered to federal civilian employees and retirees, and military retirees as an organizational benefit.

With their online store, you can shop over 40,000 brand-name goods and services and pay for them right from your paycheck. You get up to 12 months of payment – without interest, hidden fees, or credit checks.

This makes a LOT more sense than putting purchases on your credit card if you can't pay it off before interest begins to accrue.

How does it work?

Basically, their online shopping portal works like any other online shopping experience. You create an account and log in, browse through their 40,000 products and choose the items you need, add them to your cart and check out.

Items are delivered to your door and paycheck allotments begin to pay for your purchases interest-free for 5 to 12 months. It's a great alternative to loans, high-interest credit cards, and rent-to-own programs.

With Purchasing Power, you get to buy now and pay later without interest, hidden fees, or credit checks. This means if your kid still needs a new computer for school or a washing machine for their new apartment, you have options to help you pay for them.

Get 25% off your first order + Free Shipping with the promo code 25GOVSHOP

Finding The Right Apartment For College Students

I can only go by what I learned about college apartments in Athens, Georgia where my kids go to school. However, I am going to assume that most college towns are similar. Apartment prices vary widely depending on several factors, and the cost of rent and utilities is just one tiny part of the apartment costs.

First off, consider what is important when it comes to college apartments.

- Choose a safe place! SAFETY is key. Look at the number of break-ins in the neighborhood. Is it well lit? Talk to the neighbors or even call the non-emergency line for the police department. Don't skimp on safety to save a few dollars.

- Location is vitally important. Is it on the bus line for easy access to class? You may be able to skip sending them with a car if they can take the bus places. Yeah... they might complain. They are young and can walk.

- Does your kid need all those amenities? High-end apartments in Athens have outdoor pools with a lazy river and jumbotron TV. Saunas, weight rooms, and pool tables are common. You will pay for those. Personally, I was happy to pay for location and safety, not sending my kids off to a spa.

Furnishing Your College Apartment

It has taken us months of planning just to get our kid's college apartment outfitted with the basics, and that is all they have. My rule was that I bought what they NEEDED. They bought what they wanted with their own money.

These are college kids. They should be learning how to make do with as little as possible, right? Ramen noodles and a mattress on the floor are rights of passage during the college experience. I keep trying to remind myself of that!

How to decorate a college apartment on the cheap

- Hit the thrift stores regularly. From Goodwill and Salvation Army to Habitat for Humanity Restore and small antique type places, look for second-hand everything.

- Spread the word. Friends, family, neighbors, etc will probably be happy to donate their extra stuff to your college student apartment.

- Look around the house. We have gathered a lot of stuff over the years. From old chairs to mismatched dishes, my kids took a lot of stuff from home this month.

- Look online. Facebook marketplace, Craig's List, and garage sale listings will make furnishing your first apartment a lot less expensive.

- Change your outlook. I see parents share photos of their college student's first apartment and they look like upscale townhomes. Those kids are in for a rude awakening when they move out on their own and can't afford food, much less high-end decor.

- One and Done: The items we bought for my kids' dorm rooms during their freshman year are still with them today. Plan on buying things once and using them for all 4 years.

How to Afford College Apartment Costs

Do not, under any circumstance, put new furniture, decor, and rent on a credit card with 18% interest. That makes zero financial sense. Sit your kids down and have a very blunt conversation about finances with them.

Step one is for your college students to pay for some of these expenses on their own. They can get a job, even if it's just over the summer, and buy some stuff themselves. If they work during the school year, they can pay for their own utilities as well.

If you have advanced notice of their desire for apartment living, start saving a small amount every month to put towards those initial costs. Planning ahead will make it move-in month less financially stressful.

Remember that everything does NOT have to be perfect the day they move in. My kids have mattresses on the floor and no TV. They will survive. Eventually, we will find more things that they need but for now, they will live with the bare necessities.

When you need financial help, do your research. It makes no sense to rack up high-interest credit card bills so your college students can have matching drapes. If you are an employee of the federal government like my husband, you can check out Purchasing Power.

More College Tips For Parents

If you have college-aged students, here are a few more tips that might help them (and YOU) prepare for the college experience!

- College Care Package Ideas: From healthy snacks to fidget spinners, send your kids a few of these favorite college care package ideas so they miss home a little bit less!

- How To Stay Organized In College: Here are some college organization ideas that I shared with my kids as they headed off to conquer college life.

- College Readiness Starts Young: College readiness means knowing how to do laundry and make friends. Not just good grades.

Living on their own at college is a great learning experience but make sure you don't put yourself into debt trying to furnish their first apartment for them!

Diane is a professional blogger and nationally certified pharmacy technician at Good Pill Pharmacy. She has two college aged kids, one husband and more pets than she will admit to. She earned her BS in Microbiology at the University of New Hampshire but left her career in science to become a stay at home mom. Years of playing with LEGO and coloring with crayons had her craving a more grown up purpose to her life and she began blogging and freelance writing full time. You can learn more about her HERE.

Leave a Reply